ITR Filing Process in India for Non-Residents and Residents

What are the things, which should be taken care for filing an ITR in India?

This is a common question in the mind of a person (specifically Non-Residents i.e. NRIs, PIOs) who has to file an ITR in India.

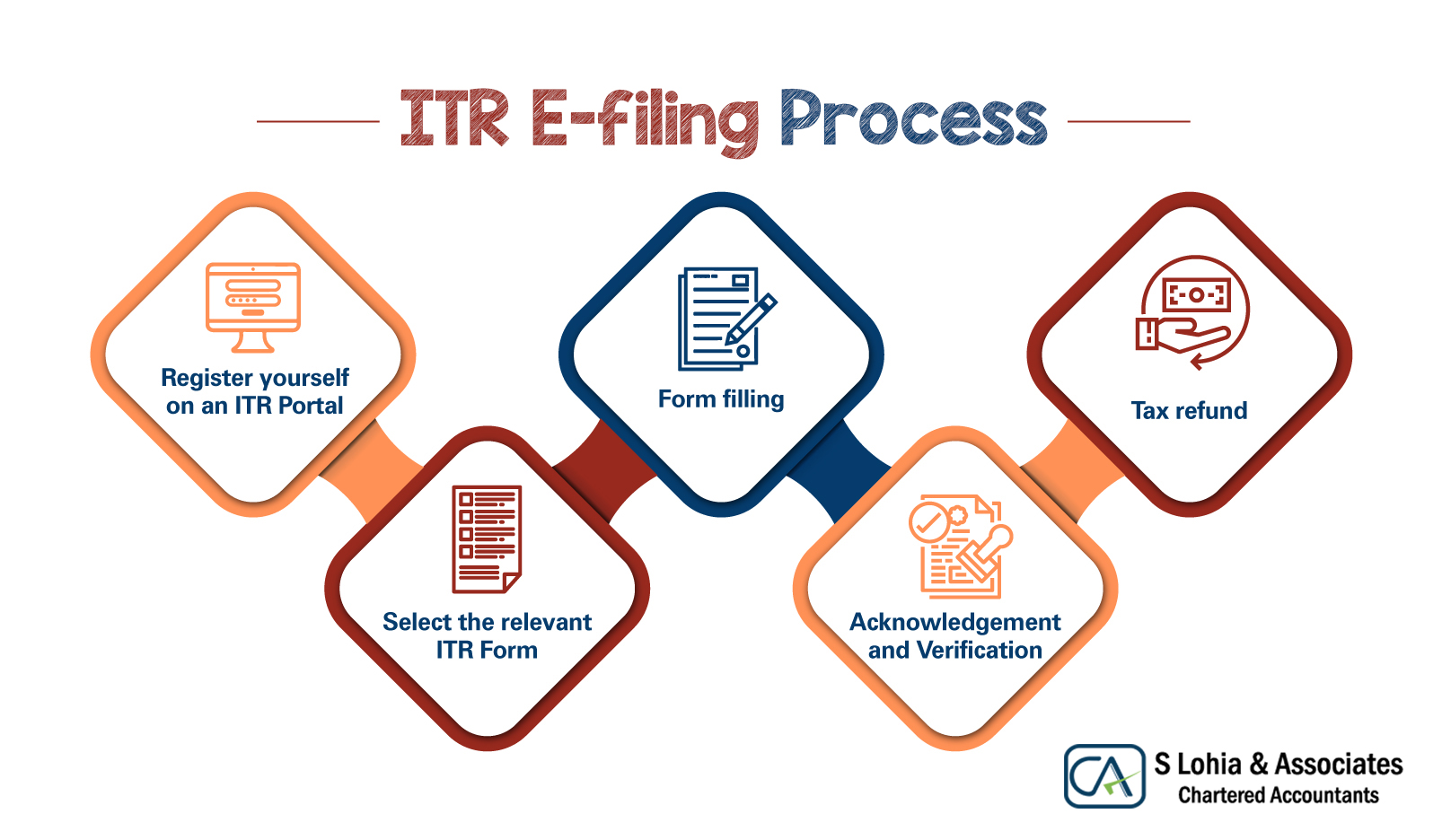

Steps to File Income Tax Returns (ITR) in India

ITR filing process in India can be divided into following steps:

- Collecting and Arranging of Documents

- Preparation of ITR Computation

- Submission of ITR

- Post ITR Filing Steps

- Processing of ITR

NRIs, PIOs, OCIs and other Non-residents can also file ITR in India for previous years and claim refund.

In the following paragraphs, these processes can be understood in detail.

1. Collecting and Arranging Documents For ITR Preparation

Following is a general list of documents that may be required to be arranged by the assessee for the purposes of preparation and filing of ITR:

Documents For ITR Filing – Resident, Non-Residents (NRI, Foreign Citizens, Expats) |

||||

| S No | Purpose | General List of Docs | Resident Indians; Returned NRIs, PIOs, Expatriates (ROR) | Non-Residents (NRI, Foreign Citizens); Returned NRIs, PIOs, Expatriates (NOR) |

| Applicability of Document Requirement | ||||

| 1 | Indian Bank Transactions | Indian Bank A/c Statements | Yes | Yes (NRO, NRE etc) |

| 2 | Foreign Bank Transactions | Foreign Bank A/c Statements | Yes | NA – Not taxable in India |

| 3 | Salary Income In India | Form 16 (TDS Certificate) | Yes | If any Salary earned in India in the relevant FY. |

| 4 | Salary Income Abroad | Salary, Salary Slips, TDS Certificate and supporting docs for salary earned aborad | Yes | NA – Not taxable in India |

| 5 | Interest Income In India | Interest Certificate (If not reflecting in 26AS) | Yes | Yes |

| 6 | Interest Income Abroad | Intt Certificate, Investment document, TDS certificate etc | Yes | NA – Not taxable in India |

| 7 | Rent Income –Property in India | Rent Agreement, Tenant PAN, Municipal Taxes etc | Yes | Yes |

| 8 | Rent Income – Property Abroad | Rent Agreement, local authority taxes etc. | Yes | NA – Not taxable in India |

| 9 | Capital Gain of Shares, Mutual Funds Sold In India | Capital Gain Summary Statement, Sale Purchase Statements. | Yes | Yes |

| 10 | Capital Gain of Shares, MFs Sold Outside India | Capital Gain Statement, Sale-Purchase Records, TDS Certificate if any. | Yes | NA – Not taxable in India |

| 11 | Capital gain/loss – Property sold in India | Property Sale-Purchase Deeds, Other support docs for exps, improvement cost, Buyers PAN etc. | Yes | Yes |

| 12 | Capital gain/loss – Property sold Abroad | Property Sale-Purchase Deeds, Other support docs for exps, improvement cost, TDS Certificate etc | Yes | NA – Not taxable in India |

| 13 | Business Income India | All Account Records etc | Yes | Yes |

| 14 | Business Income Abroad | All Account Records etc | Yes | NA – (Taxable for NORs if business is controlled from India) |

| 15 | Deductions From Taxable Income | Details, Supporting document (80C, 80D, 80G, 80E etc) | Yes | Yes |

| 16 | Home Loan Interest | Interest Certificate, Loan Statement (for Indian as well Foreign Property) | Yes | Yes

(In relation to Indian Property) |

| 17 | Indian Taxes Payment Details (TDS, TCS, Adv Tax etc) | 26AS (can be downloaded from ITR filing website) | Yes | Yes |

| 18 | Foreign Tax Credit | TDS Certificate, Foreign ITR etc | Yes | Yes (If foreign income |

Further to above, assessee needs to check 26AS and Annual Information Statement also for reconciliation of his income and other relevant details for the purposes of reporting in the ITR.

2. Preparation of Tax Computation For ITR

Once all the documents are arranged and put in one place, there should be prepared a Tax Computation. Tax Computation is very important and basic document, which reflect working and net result of all kind of incomes, expenses, deductions, rebates, taxes etc.

In future, this Tax Computation is very helpful for reference, tax department enquiry, loan/visa application and various other purposes. On preparation of Tax Computation, assessee will reach to a conclusion that whether there is any further tax payable or tax refund. If tax payable is there, then the same needs to be paid through a Self-Assessment Tax Challan.

3. Submission of ITR – Filing (E-Filing) of Income Tax Return

Once the Tax Computation is ready and due taxes are paid, the next step is to prepare the ITR Form and submit it with the Tax Department. Process of ITR preparation and submission are as under:

- Fill the details in the ITR preparing utility (excel or java utilities). It can be downloaded from IT Deptt ITR filing website (incometax.gov.in). This information can also be filled online in some cases by login into the ITR filing website (without the use of utility). After this step, a file (with extension as .xml) is created.

- In the next step, this .xmlfile needs be submitted online on ITR filing website.

- For online submitting of .xml file(or directly filing online ITR), assessee need to login into his account on the ITR filing website ((incometax.gov.in).

- For login into ITR website, assessee can create this account with the help of his PAN, Adhaar (not required for Non-Residents), personal information (address, mobile, email etc).

- Once the ITR is submitted online, immediately an acknowledgement is generated i.e. ITR V, which is an evidence of submission of ITR with the Income Tax Department. It contains important information i.e. assessee details, acknowledgement number, date of filing of ITR, income & taxes details etc. This is very helpful for various purposes.

4. Post ITR Filing Steps – Important Steps To Be Taken After Filing of ITR

After ITR submission, assessee need to take following steps:

- Check the details of ITR Acknowledgement (ITR V) if the same is matching with the computation of tax. If there is any important deviation, then there may be need to file a Revised ITR (similar process as for Original ITR).

- Do verification process of ITR i.e E-verify the ITR V by doing an online process (with the help of Aadhaar number, Bank Account etc) or ITR V can be sent in hard copy (after signing by assessee) to the ITR Central Processing Centre (Bengalore). This exercise need to be done in a timeframe (presently 120 days from ITR filing date).

- Prevalidate Bank Account. This is a process to be done at the ITR filing website. Here, assessee can submit his bank details and do a validation process. The bank account submitted here must match with the bank account details filed in ITR Form. This will help fast and electronic receipt of Income Tax Refund.

- Assessee must keep a record of all the documents in relation to ITR filing (including Basic documents, Tax Compuation, ITR V, ITR Form, .Xml file. Login details etc) very carefully with him. It will be very helpful in future for various purposes. One important thing to note is that this is the time when assessee can keep all these records safely. Later on, he will skip many information.

5. Processing of ITR (In Income Tax Department)

Once the ITR is submitted and ITR verification process is done, IT Department Central Processing Centre (CPC) do following steps:

- Verify the details of ITR Form from various parameteres e.g. complete information of ITR Form, correctness of ITR information as per Income Tax Provisions, Matching ITR form with 26AS, various other procedures etc.

- If CPC finds any missing or mismatching thing in the ITR form, it alerts the assessee by sending mail and uploading the enquiry on ITR filing web portal (in assessee account). Assessee can thereafter rectify, clarify or revise the ITR form and plug the query.

- On completion of ITR checking process, CPC process the ITR.

- On processing of ITR, CPC email an ITR processing document {i.e. Intimation U/s 143(1) of the Act}, which contains details of ITR Form and CPC processing. This may show the result exactly as per the ITR filed by assessee or there may be a difference between CPC working. Assessee can accept or submit a rectification if he donot agree with the CPC.

- Besides Intimation u/s 143(1), CPC also processes the Income Tax Refund of assessee. Assessee need to keep record of this intimation and CPC mails carefully with him.

ITR Filing In India – Other Information – NRIs, PIOs, NON-Residents, OCIs

- Aadhaar – PAN Linking In India – What Is Its Impact In NRIs, Foreign Citizens

- Filing of ITR In India – ITR Filing Rules – Non Residents (NRIs, Foreign Citizens), Indian Residents

- What are the Deductions, Exemptions and Reliefs That NRI, Foreign Citizens Can Claim In Indian ITR

- Non-Resident (NRI, PIO, Foreign Citizens) (NOR, ROR) Status Determination for ITR in India

- Residential Status New Rules Budget 2020

- Taxation and ITR For Seafarer, Mariner in India

- Why should Non-Residents (NRI, OCIs, PIOs) should file ITR in India? Any Benefit?

- What If ITR is not filed in India? What need to know by a Non-Resident for penal provisions and consequences of not filing ITR in India?

- What are the transactions which form part of a Non-Resident ITR in India? Scope of NRI ITR

- What are the ways out of filing ITR in India by Non-Residents for Past Years?

Frequently Asked Questions (FAQs)

Q: What are the documents required for filing of ITR in India by Non-Residents (i.e. NRIs, PIOs etc)?

Ans: The requirement of documents are dependent on the facts and transactions of Non-Residents. In general, Non-Residents foreign income are not taxable in India. Hence, Non-Residents need to arrange their documents in relation to their Indian transactions i.e. Bank Account Statements of NRO, NRE Bank Accounts, Mutual Fund & Shares transactions records (along with capital gain summary for sales incurred), 26AS, Rent income realted records etc. A detailed lists, which is applicable for Non-Residents is provided above, which can be referred to.

Q: Whether Non-Residents (NRI, Foreign Citizens) need to provide documents and information in relation to income and assets outside India in their Indian ITR?

Ans: Non-Resident Indians, Foreign Citizens (PIOs, OCIs, Others) need not to provide their outside India income and assets related documents or information in the ITR filing in India. As per Indian Tax Provisions, there is no requirement of providing such information in Indian ITR. Its outside the scope of Indian Taxation and Indian ITR.

Q: What If I made any mistake in my ITR filing? What is the way out if I skipped any income to be submitted in the ITR form? What is the process if I have not submitted the ITR form correctly?

Ans: If there is any information missed or incorrectly filed in the original ITR, then there are two way outs. Firstly, you can correct it yourself by submitting a Revised ITR. Secondly, CPC also verify the ITR and reconcile it on various parameters, and if any inconsistency is found it informs that to the assessee, which assessee can correct under the correction umbrella.

Q: I am an NRI. What do I need to know about the process of filing of ITR in India? What are the documents and information should I arrange for the filing of ITR?

Ans: As an NRI, you may kindly arrange all the information and documents in relation to your income and assets in India. There is no requirement of information or documents in relation to outside India Income and Assets. For more detailed list, you may kindly refer to the table above.

Q: As a Non-resident (NRI, Foreign Citizen i.e PIO, OCI), should I keep any records of ITR filing once ITR is submitted? What is the importance of ITR filing documents in future? What should I need to do about records maintenance after ITR filing? What are the important documents I need to keep as records in relation to filing of ITR?

Ans: Once the ITR is filed all the assesses (including Non-Resident Indians, Foreign Citizens) need to maintain and keep a record of all the documents in relation to ITR Filing. In future, for any income tax query or proceeding, and also for any other purposes, these ITR records are very important to stand as evidence. The main important documents in relation to ITR filing are Login Details of ITR Website, ITR Acknowledgement, ITR Form, .XML File, Tax Computation, Bank Statements, Docs in relation to all the income and deductions submitted in the ITR form, any other document relevant to the information submitted in ITR Form.

Q: I am a Non-resident. I wish to know that how much time it takes for processing of refund after filing of ITR? What is the process of refund after filing of ITR by NRI? What is the way out to get the refund fast in relation to NRI ITR in India?

Ans: Once NRI submits or files the ITR with the tax department online, the ITR verification process happens at Central Processing Centre Bangalore. ITR Form is verified and reconciled for all the information and claims in the ITR. Thereafter, if everything is found ok, CPC process the ITR (via an Intimation u/s 143(1)) and process the refund also. For online receipt of refund, assessee can do his bank details pre-validated on the ITR Filing web portal. Some of the ways to get fast and early refund are timely filing of ITR, Correct filing of ITR, Immediate E-Verification of ITR Filing, Pre-validation of Bank Details.